By the time these lines are put into publication, as per John Hopkins University, over 2.3 million population of the word has been diagnosed with COVID-19 and this disease has taken more than 162k lives all over the world. This disease which is now officially declared as pandemic has driven 1/3rd of world population into lockdown. It is feared that this disease will result one of the worst economic recession world has ever seen in its recent history following by major job losses, unprecedented industry shutdowns, huge budgetary deficits, hyper-inflation and the worst out of all i.e. food shortages, God Forbids.

Governments all over the world are battling hard to reduce the spread of this disease and also announcing financial relief packages for their people and businesses. Prime Minister of Pakistan has recently announced that his government has allocated USD 8 billion as Coronavirus relief package. Various administrative and policy measures are being taken to ease out the situation for the businesses and people including softening the regulatory compliances, reducing tax and interest rates, allowing extension in compliance deadlines and removing procedural delays of the system.

Likewise, Prime Minister of Pakistan also announced a major relief package for construction sector on April 3, 2020 which can be accessed at https://uzandco.com/2020/04/07/stimulus-package-for-construction-sector/. Later, major Income Tax related changes are promulgated through the Tax Laws (Amendment) Ordinance, 2020 on April 17, 2020 which are being presenting in this document. This Ordinance adds a new section i.e. 100D and relating rules through a new schedule i.e. Eleventh Schedule in in ITO, 2001.

Please share your feedback and queries at contact information provided on last page of this document.

A.1) Amnesty Scheme for Builders and Developers for Investment

Introduction

Amnesty for Builders and Developers for Investment

Immunity from provisions of section 111 of ITO, 2001 granted thus, no tax liability, no penalty and no disclosure of source of income.

Deadline

- Deposit title transfer & FBR Declare by: 31-Dec-2020

- Project completion by: 30-Sep-2022

Eligible Persons

- Sole-proprietor

- AoP

- Company

Ineligible Persons

- Public office holders or their Benamidars

- All criminal proceeds except tax evasion proceeds

- REITs, listed companies or exempt income companies as per ITO

Eligible Projects

- New building construct & land development

Conditions & Manner

1. Investment not made from borrowed money

2. AoP & company newly registered/incorporated as single object entity before 31-Dec-2020

3. Land be taken in wealth statement at higher of 130% of value as determined in section 68 of ITO or, at the option of declarant, lower of the values as determined by at least two valuers from SBP panel.

4. With regards to completion of project:

- Builder: A certificate for completion of grey structure from NESPAK or relevant approving authority.

- Developer: All of the following be submitted:

- Certificate of completion of landscaping from NESPAK or relevant authority;

- Certificate of laying atleast 50% roads to sub-grade level by NESPAK or relevant authority; and

- Notified QCR CA certificate for atleast 50% plot booking & atleast 40% recovery of sale proceeds

5. Amnesty by Sole-proprietor:

- Money: Must deposit in new bank account as per deadline

- Land: Must possess the title of the land at promulgation of this Ordinance

6. Amnesty by AoP/Company

- Money: Deposit it in AoP/Co a/c through crossed banking instrument as per said deadline

- Land: Member/shareholder possesses the title of property by promulgation of this Ordinance and transfer this title to AoP/Co as per said deadline

A.2) Amnesty Scheme for First Purchaser

Introduction

A complete immunity from provisions of section 111 of ITO, 2001 granted on investment made in construction sector thus, no tax liability, no penalty and no disclosure of source of income.

Deadline

- Full payment of plot and start construction by: 31-Dec-2020

- Construction on plot must complete by: 30-Sep-2020

- Full payment of building/unit made by: 30-Sep-2022

Eligible Persons

- Individual

Ineligible Persons

- Public office holders or their Benamidars

- All criminal proceeds except tax evasion proceeds

- REITs, listed companies or exempt income companies as per ITO

Eligible Projects

- New & existing building/unit

- Purchase of land

Conditions Specific to Purchase

- Declaration be made on FBR portal

- Purchase of Building/Unit

Directly being purchased from builder (First Purchaser)

- Payment is being made through crossed banking instrument

- Purchase of Land

Purchase of plot for construction purposes

- Full payment through crossed cheque to seller of land

ValYou Insights

- Strange: if a person has a plot before this ordinance & want to use it for construction then he/she can’t declare it under this scheme

- For construction, cross cheque payment to builder is a mandatory condition. A huge chunk of population prefers to construct their houses without engaging a builder or if they even engage a builder then they don’t get material from him/her therefore, it is virtually impossible for such type of people to declare the whole construction cost under this scheme.

B.1) Option to Opt Final Tax Regime

Introduction

- An option is provided on Project-by-Project basis to the construction sector for opting Final Tax Regime under the head of Business Income in place of Normal Tax Regime.

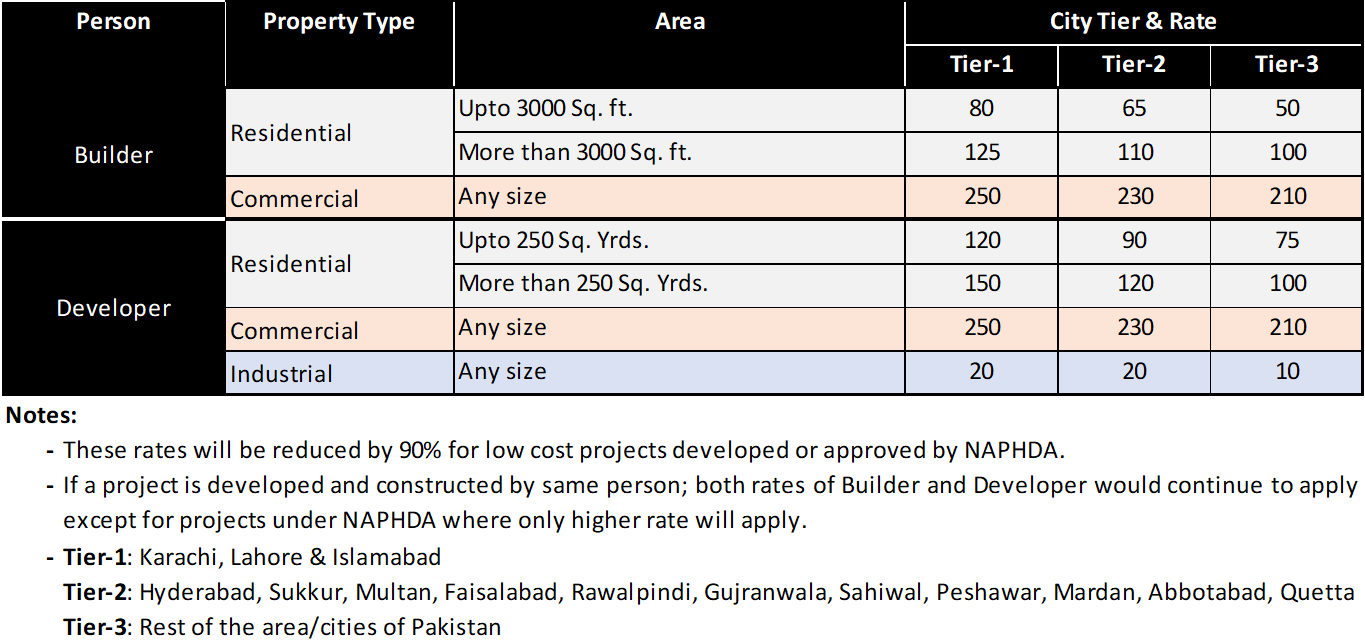

- Under this, tax will be charged on the basis of project area at rates provided in Annex-B.

Deadline

Project complete by 30-Sep-2022

Exercise FTR option not later than 31-Dec-2020

Eligible Persons

- Individual

Ineligible Persons

- Public office holders or their Benamidars

- All criminal proceeds except tax evasion proceeds

- REITs, listed companies or exempt income companies as per ITO

Eligible Projects

- New & existing building

- Purchase of land

Conditions Specific to Purchase

- Declaration be made on FBR portal

- Purchase of Building or Unit

Directly being purchased from builder (First Purchaser)

- Payment is being made through crossed banking instrument

- Purchase of Land

Purchase of plot for construction purposes

- Full payment through crossed cheque

ValYou Insights

- Strange: if a person has a plot before this ordinance & want to use it for construction then he/she can’t declare it under this scheme

- For construction, cross cheque payment to builder is a condition. A huge chunk of population prefers to construct their houses without engaging a builder therefore, perhaps, they will not be benefitted from this scheme.

B.2) No Withholding Tax by Builder/Developer

Introduction

No tax will be deducted by a Builder/Developer.

Deadline

Not applicable

Eligible Persons

- Builder

- Developer

Exceptions

Tax will be deducted only from the following:

- Suppliers of cement and steel

- Companies providing services like plumbing, electrification, shuttering and other similar services

ValYou Insights

This will reduce cost of doing business for construction sector and will simultaneously encourage suppliers and services providers of construction sectors operating in unorganized sector.

C.1) Waiver in Tax on Capital Gain

Introduction

100% exemption granted on capital gain earned by the seller of constructed property.

Deadline

Not applicable

Eligible Persons

Resident Individuals

Conditions

- Must be a residential property used by individual, spouse or dependents proven by atleast one utility bill

- No exemption availed earlier by individual, spouse or dependents means this exemption is only valid for first transaction and not thereafter

- Property must not exceed by:

- House: 500 sq. yards (land area)

- Flat: 4000 sq. feet (assumed to be covered area)

ValYou Insights

As per the provisions of this clause, sale of a let-out or vacant residential property will not qualify for claiming this exemption. This will be difficult to ascertain the residence of individual or his/her spouse & dependents therefore, enforceability of this clause may create frictions between tax authorities and tax payers.

C.2) Exemption of Share in Profit or Gains

Introduction

No tax on amount received from profit and gain as dividend.

D.1) Miscellaneous Provisions

Change of Ownership of Builder/Developer

FBR will not allow change of ownership after registering a project except:

- A hardship case

- Atleast 50% of total cost incurred as certified by an FBR’s notified QCR rated firm of Chartered Accountants

- Succession to legal heirs in case of death

- Additional members/shareholder may be allowed after 31-Dec-2020 but they will not be offered amnesty.

Reduction in W/H Tax on Auctioned property

Earlier Rate of withholding tax u/s 236A of ITO was 10% which is now being reduced to 5% at gross value of auction price.

How to Pay Tax under This Scheme

For tax year 2020, liability will be discharged with the tax return and for later tax years Section 147 will apply which required discharge of yearly liability in four equal instalments.

Yearly liability will be calculated as per the following formula:

Yearly Liability=Total FTR Liability/No. of Years to Complete the project (must not exceed 3 years from tax year 2020 and 2.5 years from the date of FBR registration for existing & new projects respectively).

Benefits of Being Industrial Undertaking

W.e.f. May 1, 2020, persons involved in construction or development of:

- Buildings

- Roads

- Bridges

- Land

- Other structures

will be included in definition of industrial undertaking. Therefore, now this sector can import machinery without tax deduction at import stage by getting exemption certificate on account of their income being subjected on FTR regime.

Abolishment of CVT in Federal Capital

In line with few other provinces, federal government has also abolished Capital Value Tax (CVT).

E.1) ValYou Added Suggestions

Although this ordinance contains various initiatives those will have a positive impact on the construction industry and business sectors associated with it but the following measures should also be considered for extending the warmth of support further from the policy makers in upcoming Finance Bill 2020-21:

100% Tax Exemption for Certain Rural/Remote Areas

Geographical area specific 100% tax exemption should also be granted for rural area economic uplift as this package may be deemed by some as a package for urban pockets.

Increase in Limited of Deductible Allowance of Profit on Debt

Limit for deductible allowance on profit on debt u/s 60C of ITO, 2001 i.e. needs to be linked with the policy rate. In 2016, this limit was determined at Rs. 2 million when policy rate was 5.75% but it is not increased ever since though policy rate has been increased more than double.

Encouraging Banks to Lend More to Construction Sector

In 7th Schedule of ITO, 2001 (Banking Company Taxation), currently tax reduction is given on bank’s portfolio relating to low cost housing project. This should also be enhanced and the whole construction sector should be included therein.

Discounted Markup through Refinancing Scheme

While encouraging banks to finance more low cost housing projects, government should also extend its refinancing facility to banks for financing first house purchase/construction taking into account middle class community needs as well. It can limit the maximum exposure per account or even can fix a reasonable maximum value of these middle class housing projects

Inclusion of Infrastructure Development Projects

Projects of road, bridges, water channels and other public infrastructure were not considered for Final Tax Regime although these are included in the definition of industrial undertaking alongwith construction sector.

Annex-A: Glossary of Terms/Abbreviations

- Area: House: covered area, Land: total land area, Others: Saleable area

- Builder: A person who is registered as a builder with the Board and is engaged in the construction and disposal of residential or commercial buildings

- Developer: A person who is registered as a developer with the Board and is engaged in the development of land in the form of plots of any kind either for itself or otherwise

- Project: A project for construction of a building with the object of disposal, or a project for development of land into plots with the object of disposal or otherwise

- Building Includes all types of residential and commercial buildings

- Date of commencement of project: The date of approval of layout / development plan respectively by the concerned authority. Board may accept a project after the cut-off date i.e. December 31, 2020 if it is satisfied that request for approval submitted thirty days ago and no approval received from the authority till cut-off date.

- Date of completion of project:

- Construction project: The date when grey structure is completed i.e. roof of top floor plan is laid as per approved plan

- Land development project: The date when:

- Atleast 50% plot are booked in the names of buyers

- 40% sale proceeds recovered

- Landscaping has been completed

- 50% of the roads are laid up to subgrade level as certified by approving authority or NESPAK

- Low cost housing schemes: Housing schemes which are approved or developed by:

- Naya Pakistan Housing and Development Authority

- Ehsaas program

- ITO: Income Tax Ordinance,2001

- AoP & Co: Assocation of Persons & Company

Annex-B: Rates of Income Tax under FTR

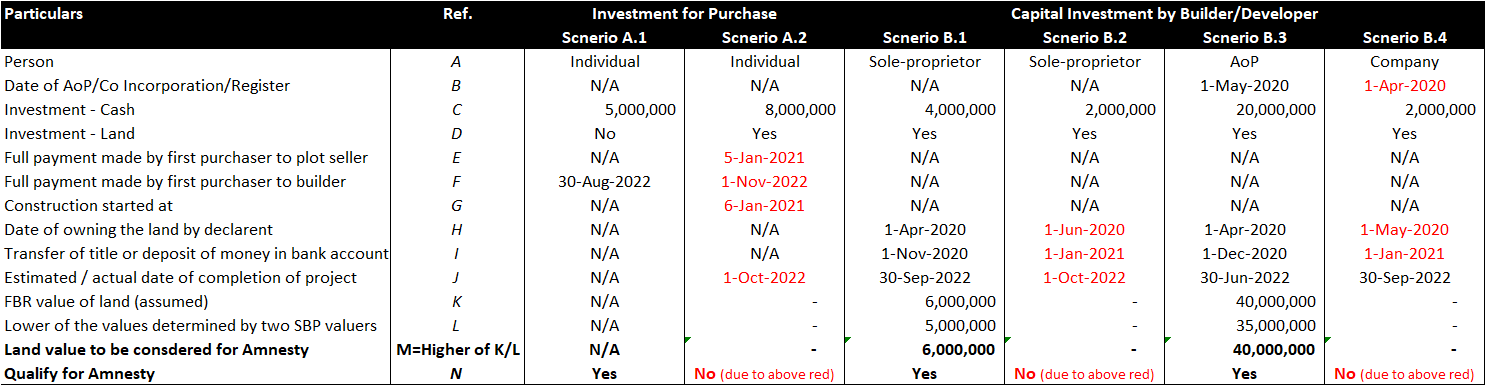

Annex-C: Illustration – Amnesty & Valuation

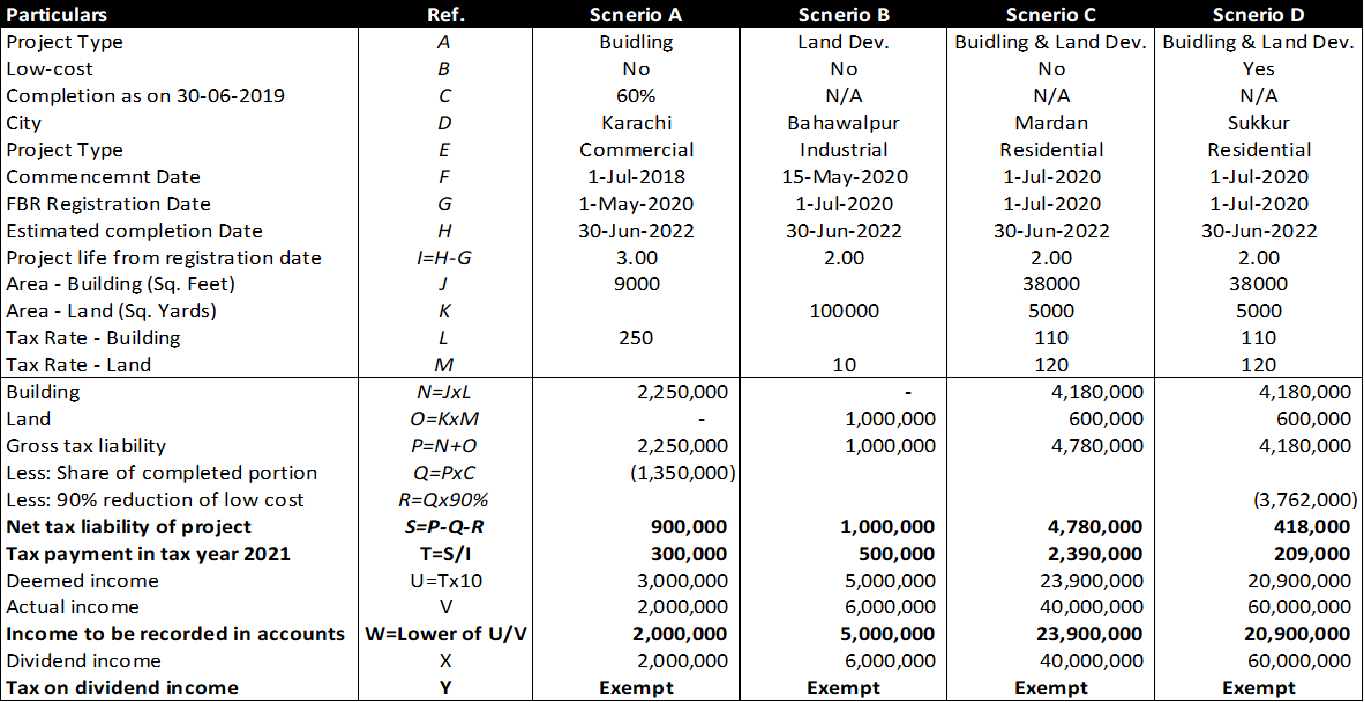

Annex-D: Illustration – FTR Regime & Tax Exemption

Disclaimer

Information contained in this document is only for the guidance purposes and all the insights / commentary provided therein are the viewpoint of the ValYou which are developed considering a general perspective therefore, application of these guidelines in a particular scenario / case may produce incorrect results.

We tried our best to provide accurate information but there could be some errors or omissions therefore, we advise you to refer the original document / statute first before proceeding further.

thanks for your support