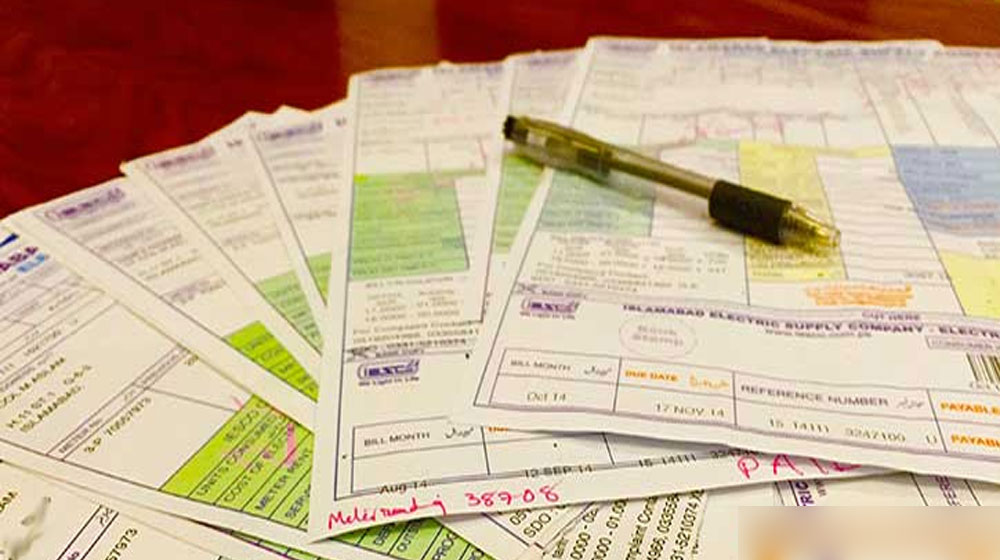

Non-filer consumers who use more than Rs. 25,000 worth of electricity per month will now have to pay an additional 7.5 percent tax on electricity bills.

Lahore Electric Supply Company (LESCO) announced through its website that the government had implemented a new withholding tax (WHT), effective from July 1, 2021.

The statement on LESCO’s website reads, “Dear customer! The government of Pakistan has imposed a 7.5 percent tax on electricity bills of over Rs. 25,000 monthly. If you are a filer, immediately send your reference number, along with identity card number on 8118, so that you can be exempted from this tax.”

The Federal Board of Revenue (FBR) recently issued Income Tax circular 2 of 2021, which slashed the threshold of monthly electricity bills for WHT from Rs. 75,000 to Rs. 25,000 for domestic users not appearing on the Active Taxpayers List (ATL).

Until now, WHT was being collected irrespective of consumers being filers or non-filers, but the WHT applied only to bills exceeding Rs. 75,000.

On the face of it, this move seems logical as it is progressive with higher consumption being taxed heavily in case of non-filing of returns. However, experts on the matter believe that there are certain loopholes in this decision.

They noted that the electricity connections are not always in the names of people living in the residence, especially in rented housing. Even in self-occupied houses, numerous connections were issued in the name of the parents or grandparents of the people living in the house. This can create a natural flaw, as a tax-filing resident may be subjected to the WHT due to the connection being registered in the name of a non-filer.

This will mean that a massive drive might be needed to transfer the titles of electricity connections in the names of the actual residents, which still won’t be possible for rented houses.

Furthermore, those exempted from filing tax returns, such as agriculturists, will also have to face additional troubles with this new policy.

Courtesy: Pro Pakistani