As a routine annual ritual, we are pleased to present our bulletin on key changes proposed through Finance Bill, 2023 commonly known as Federal Budget 2023-24. This bulletin contains key changes in tax laws and our feedback wherever it is considered pertinent and relevant.

Federal Budget 2023-24 is going to be the second and most likely the last budget of the Sharif-Led coalition government. This budget is being presented on a very critical time as at one side Pakistan is facing severe economic challenges like depleting foreign exchange reserves, raging inflation and rising unemployment and on other side Pakistan is facing grave political unrest. This budget is being presented by this government when the national assembly tenure is about to end so it is highly likely that the new government would present their supplementary budget after assuming charge.

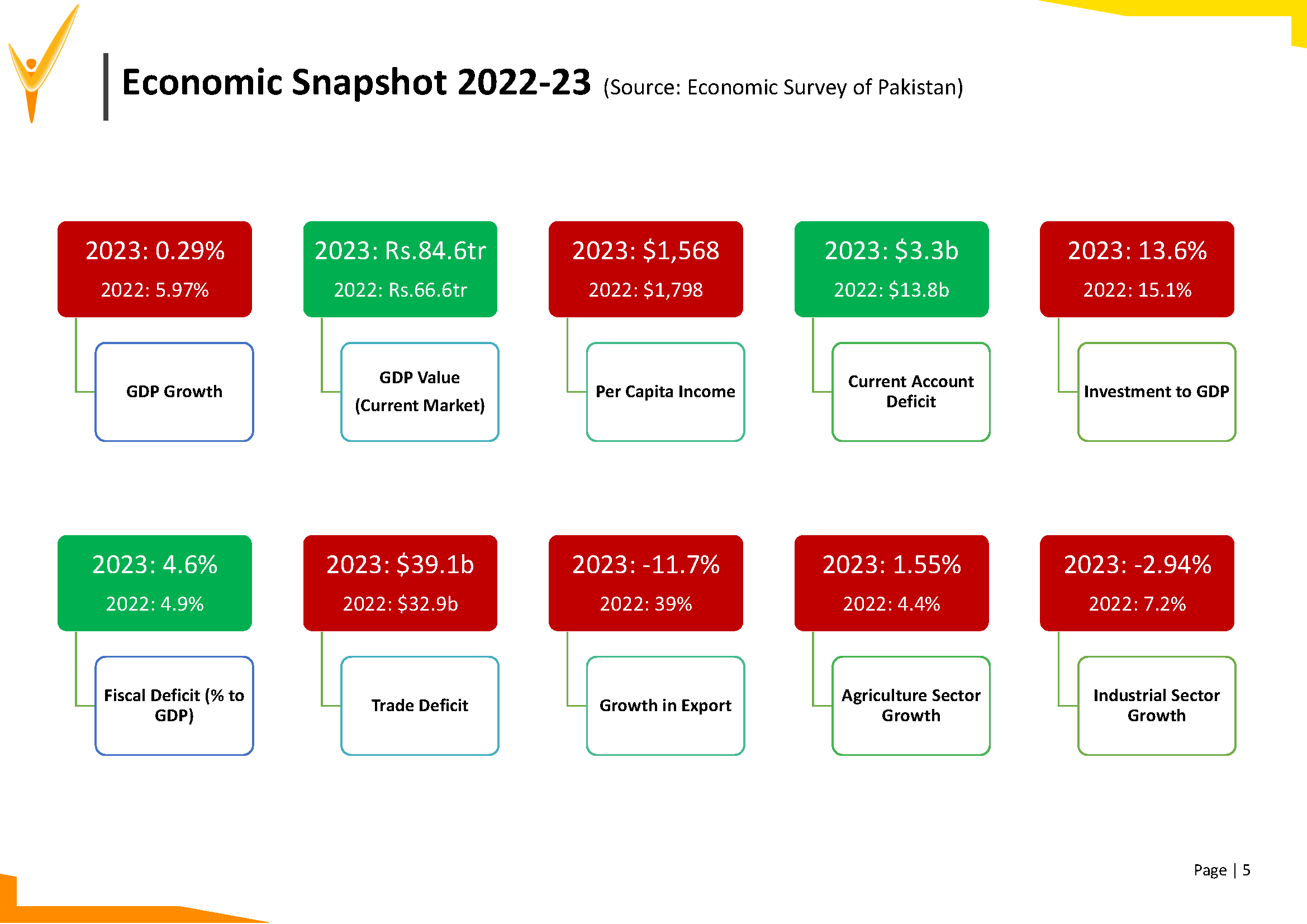

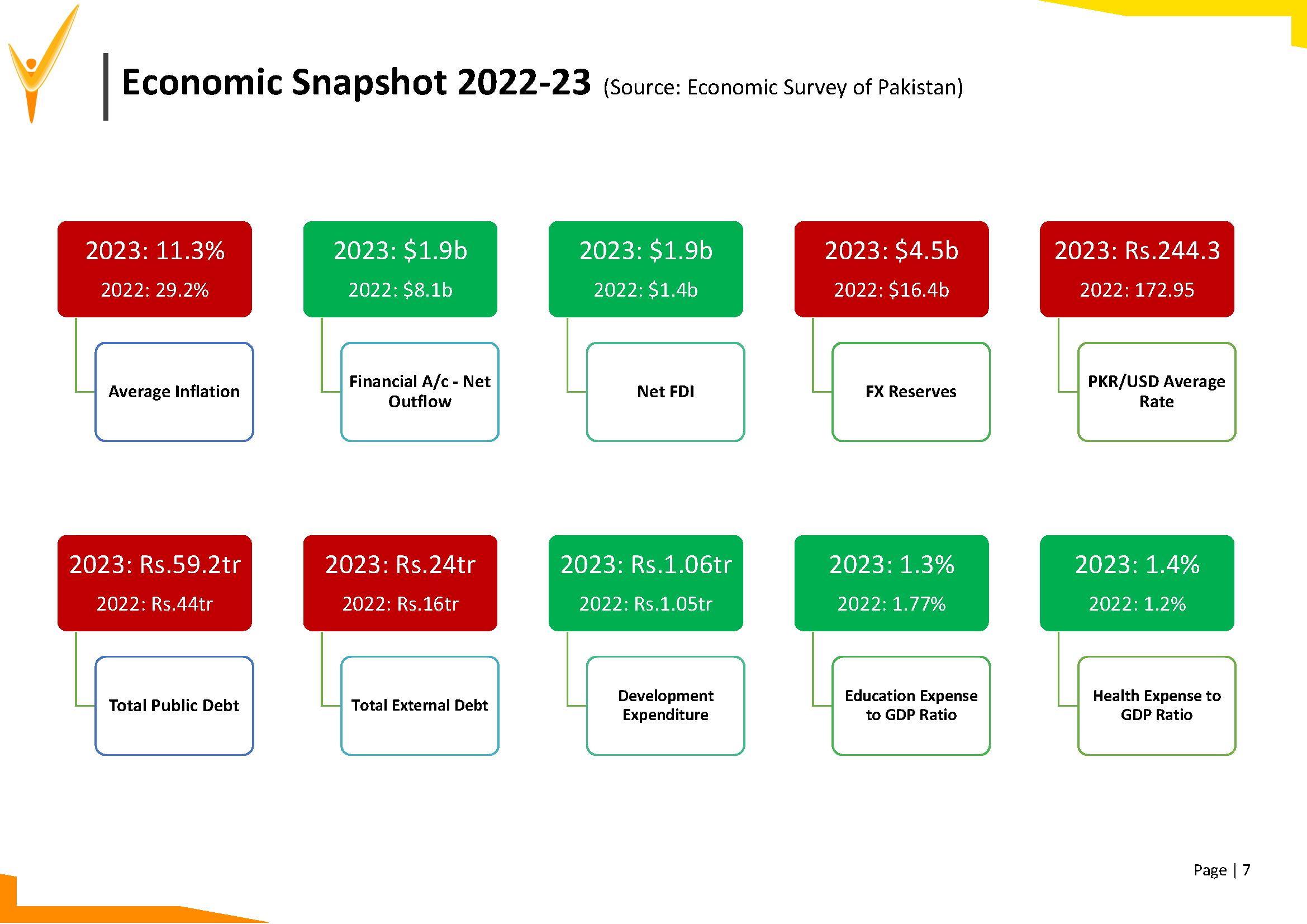

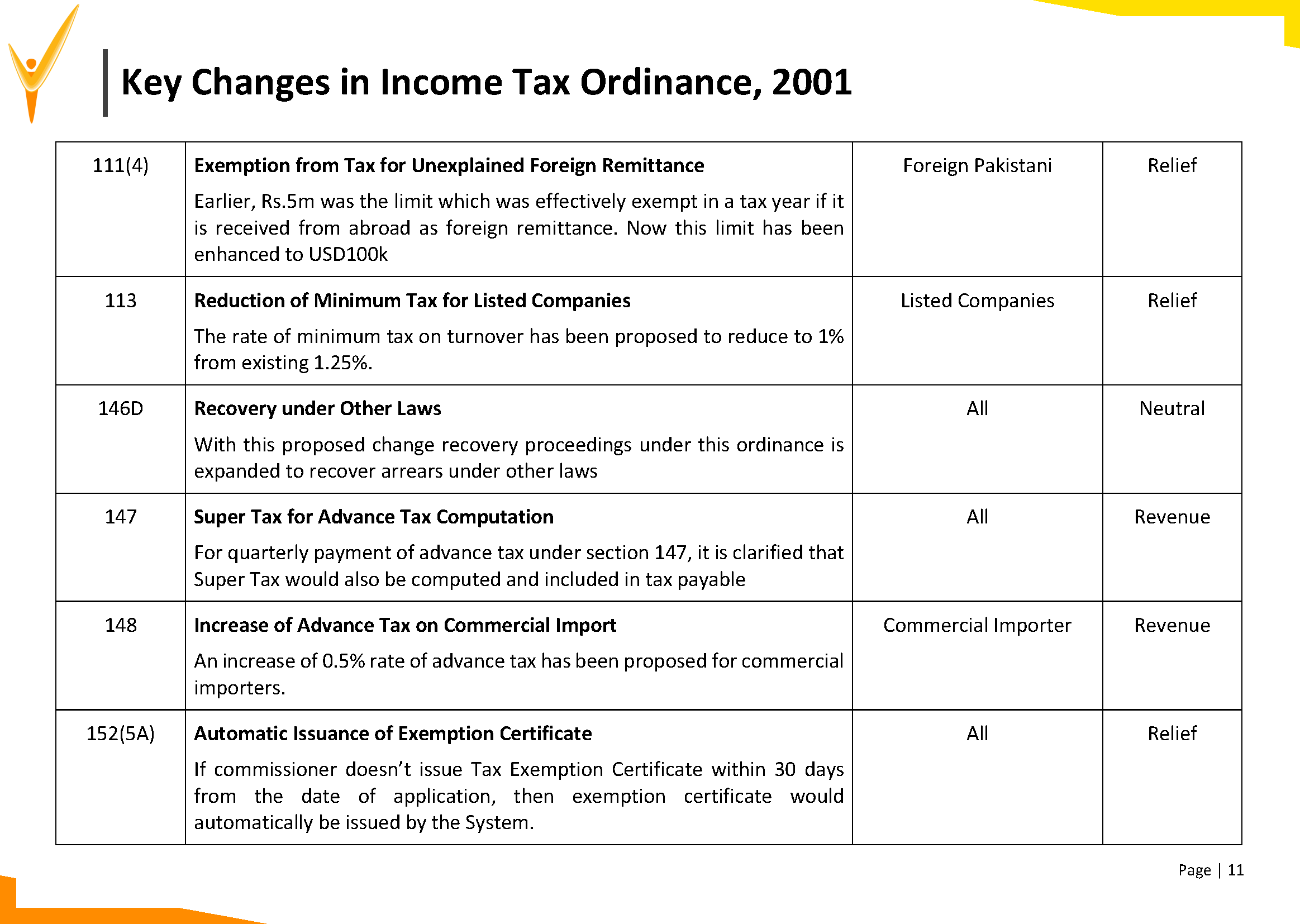

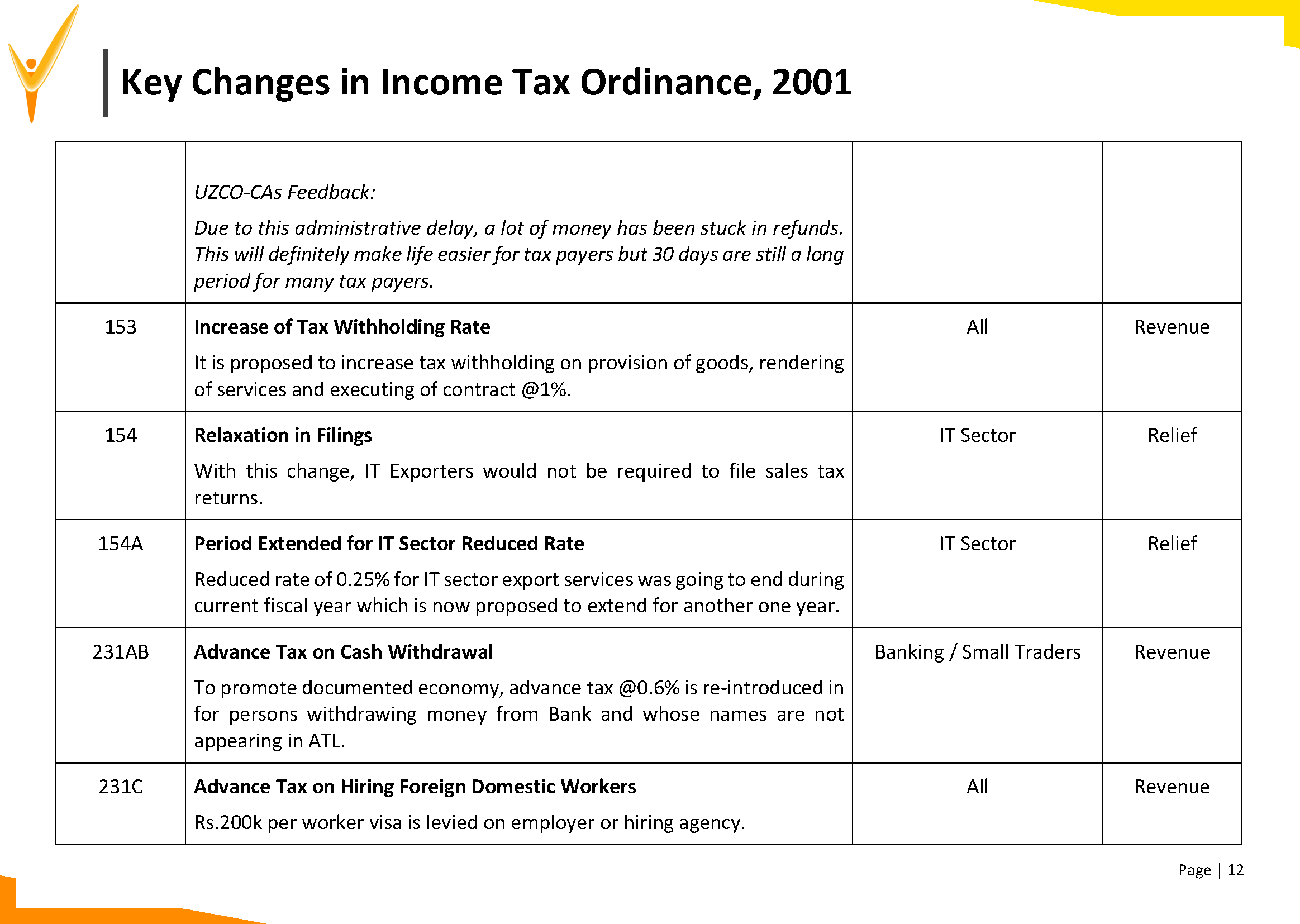

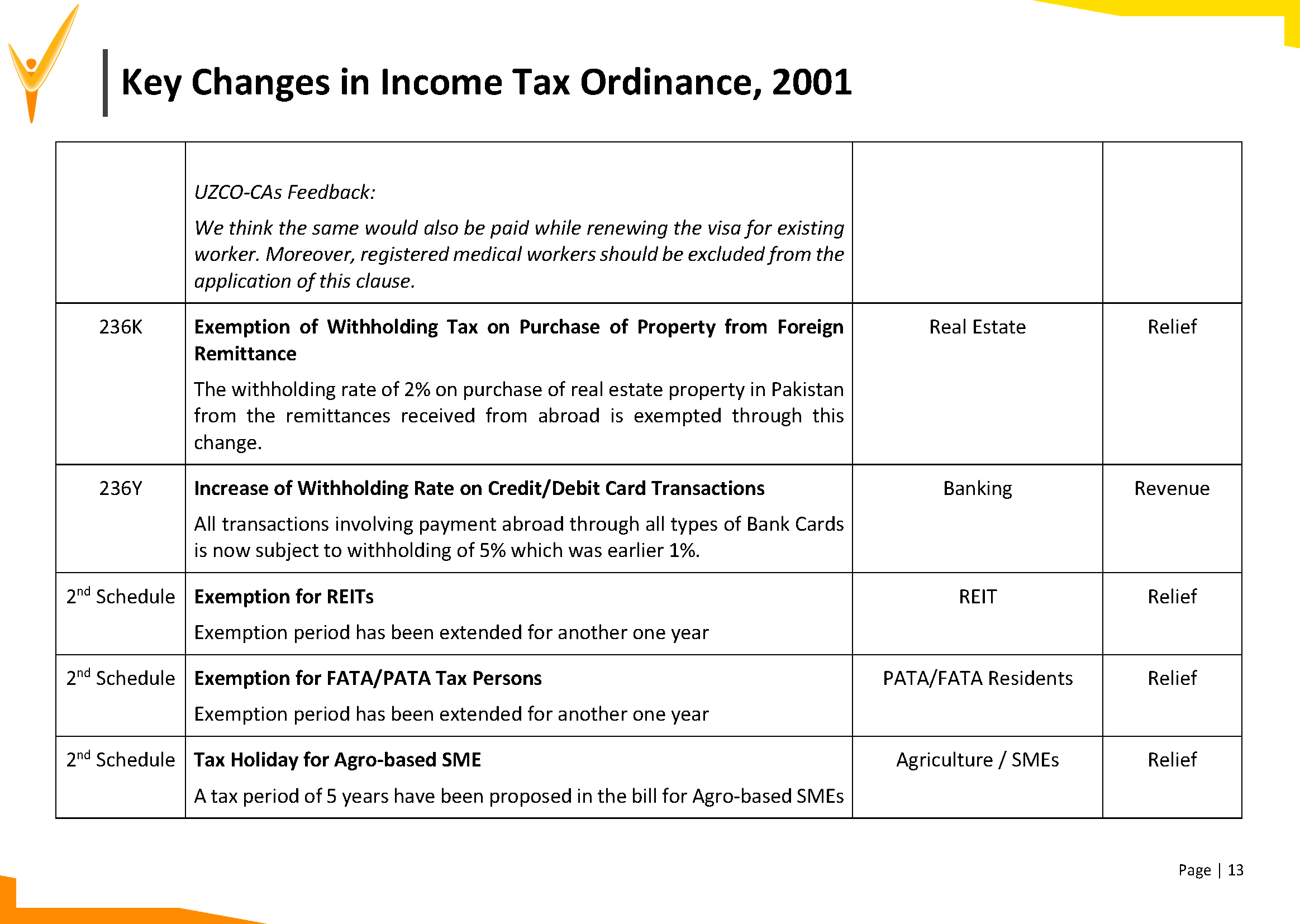

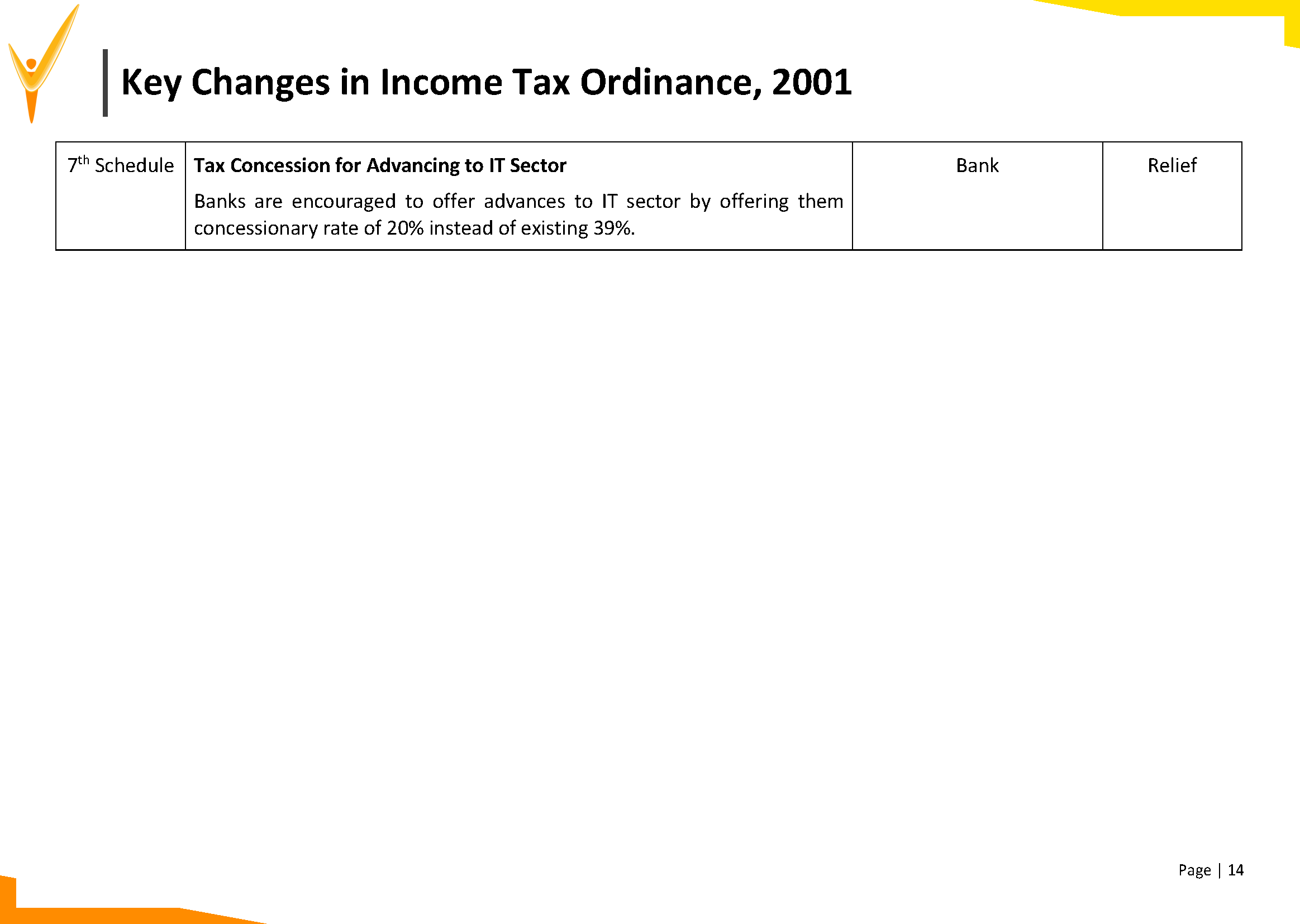

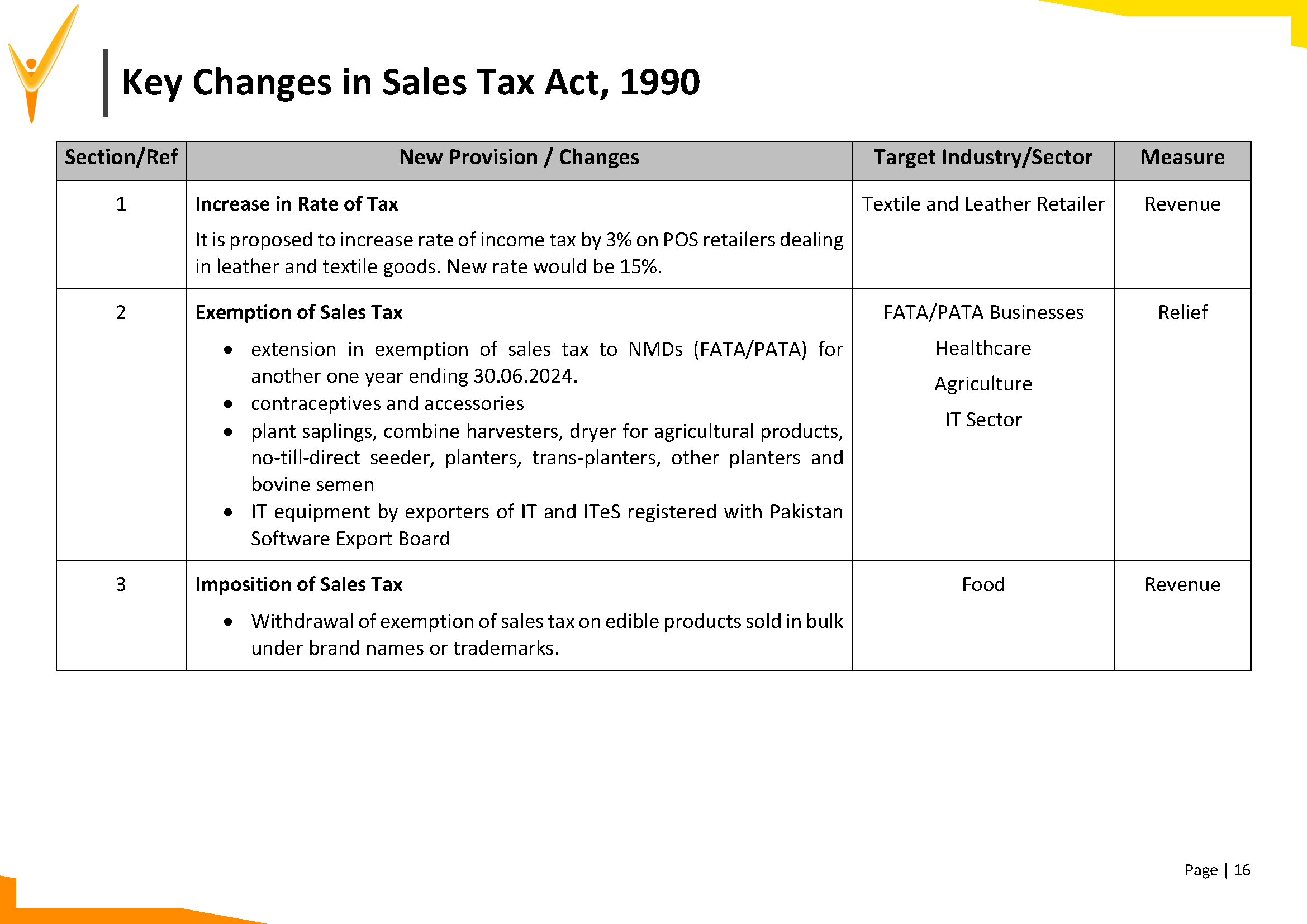

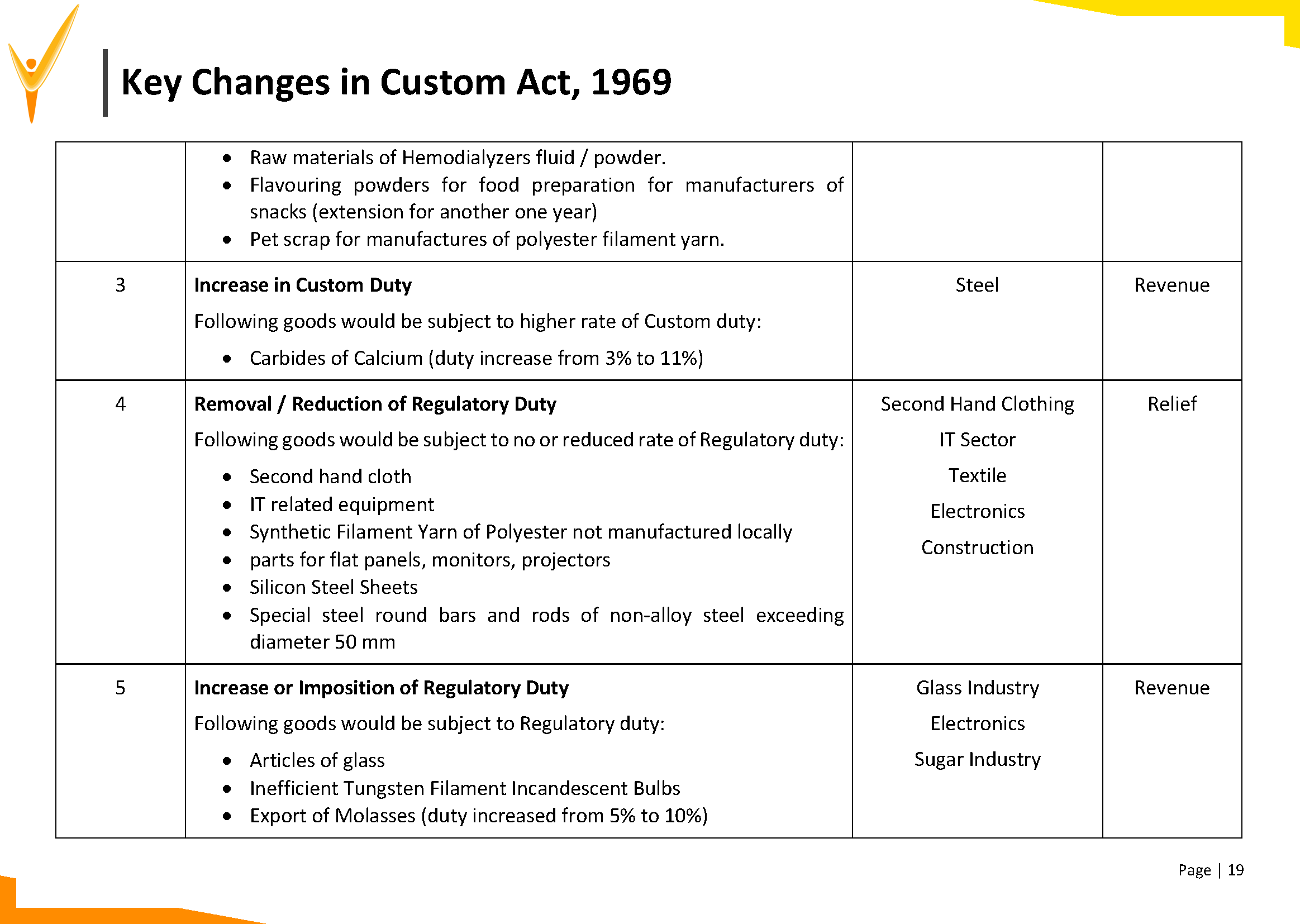

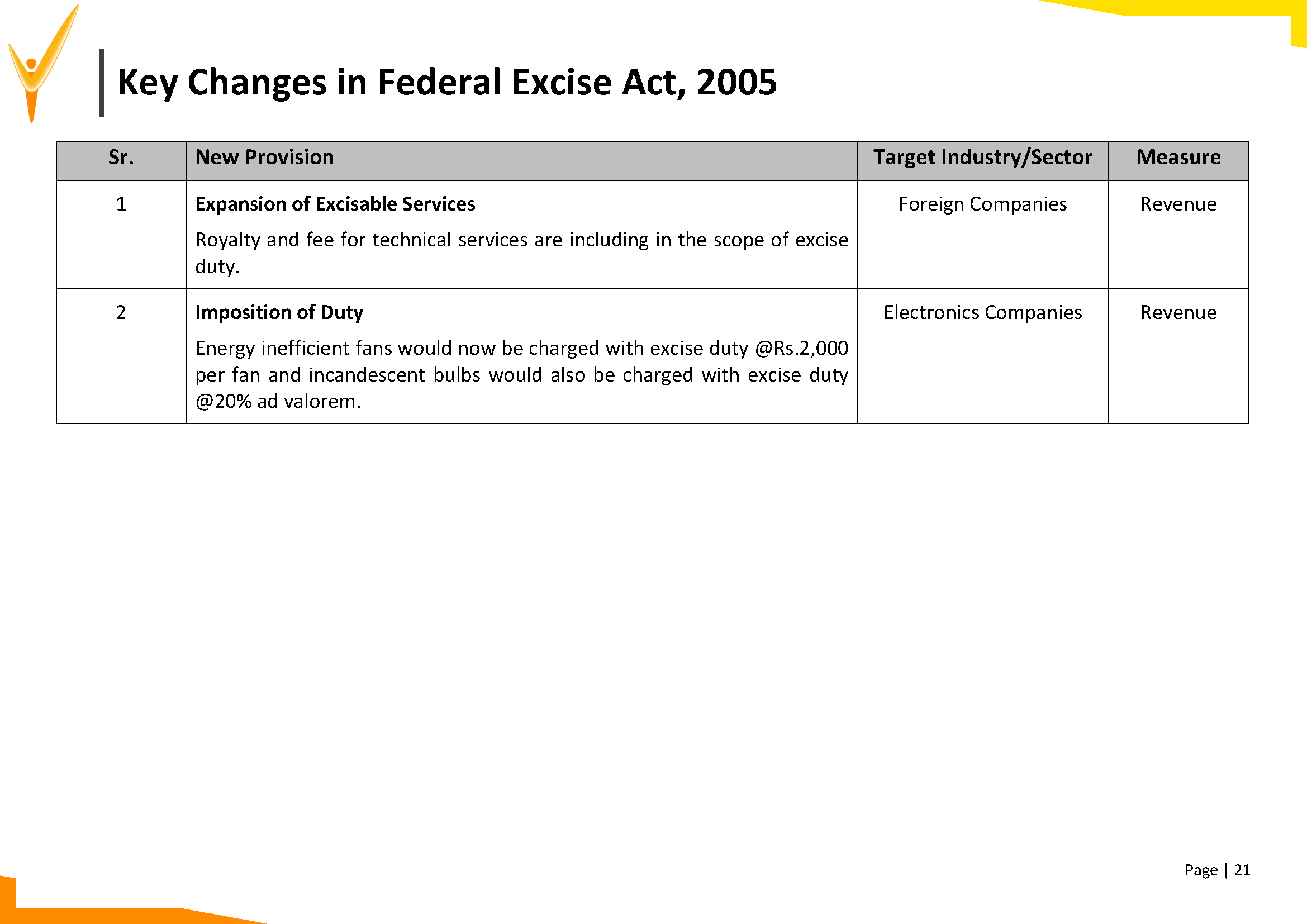

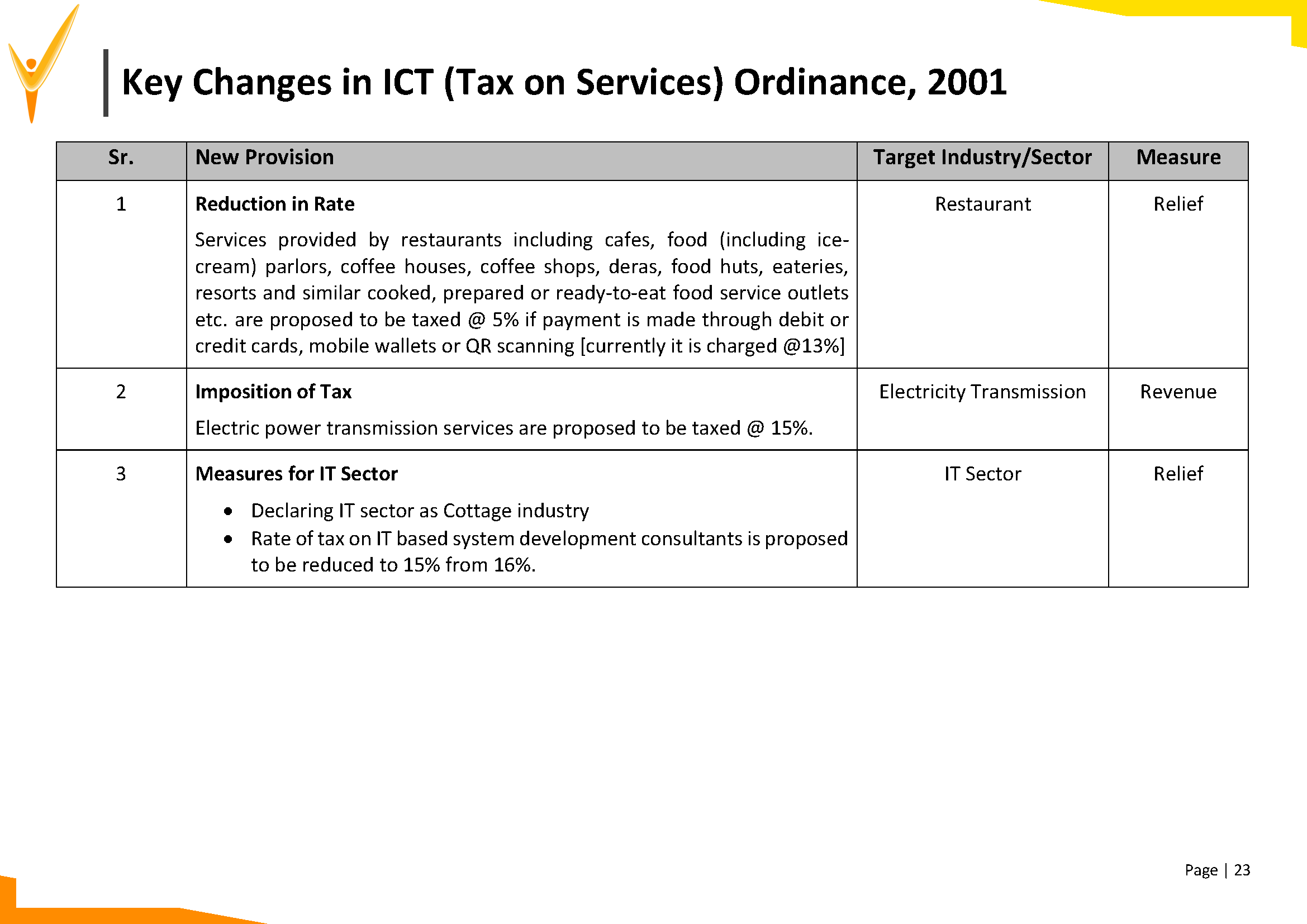

Recently publicized Economic Survey of Pakistan for year 2022-23 has shown a very gruesome picture of the economy as almost all indicators are lacking behind their targets. In this budget, IT, Construction, Real Estate, Agriculture, SMEs and Alternate Energy sectors are the major gainers whereas, Large Scale companies, Commercial Importers and Tier-1 Retailers are in the list of major losers. Moreover, a hefty adhoc allowance 30%/35% for government employees is also proposed whereas, no tax cut was proposed for private sector employees.

We would love to hear your feedback on this bulletin. Kindly, share your feedback at connect@uzandco.com. We also advice our readers to take expert opinion before acting on certain piece of information provided in this document. UZCO-CAs wishes luck to our beloved country and its citizen. May this budget and initiatives proposed bring prosperity for Pakistan and its citizens, aameen. Pakistan Zindabaad!!!