PayPal is a US-based electronic payment system that acts as a third party for financial payments between two parties. It has a strong position in the online fund transferring market.

However, unfortunately, it is not working/coming in Pakistan despite a lot of demand and effort. There are several buzzwords in the market about the absence of PayPal. Money laundering, FATF, and exchange control regime are the most important reasons that have been told in this regard.

However, there is not a single comprehensive study available on this issue. This small brief is an attempt in this way.

Pakistan Institute of Development Economics (PIDE) carried out a detailed study on the merits of PayPal, the challenges that are in the way of it becoming operational in Pakistan, what regulatory and control parameters need to be in place before we can adapt PayPal, and what does Pakistan need to offer for the payment platform to consider setting up shop in the country. Here is what the report uncovered:

Why Do We Need PayPal?

Though PayPal is needed for a variety of financial transactions, the freelancing community is directly connected with this service. Notably, Pakistan is a significant freelance exporter with a growing market over the last three years.

Therefore, the freelancing community is facing massive trouble in receiving payments in the absence of well-trusted electronic payment service providers. Resultantly, they use informal/illegal or indirect ways for creating PayPal accounts in Pakistan.

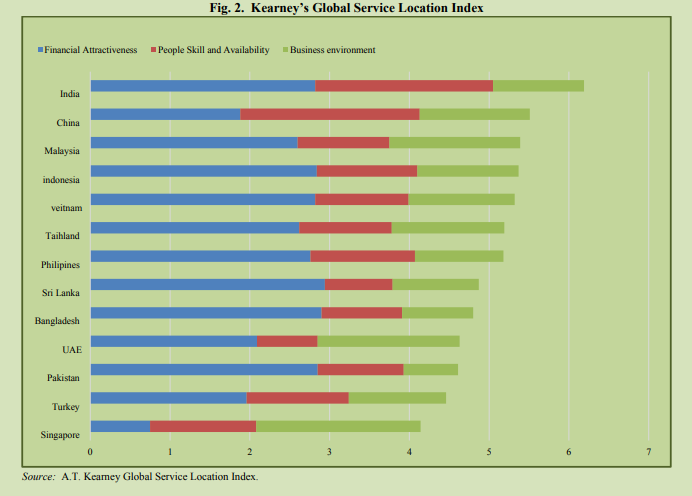

Pakistan has a good contribution in the freelance markets and has an attractive destination for offshore service. According to GSLI of 2019, Pakistan is the 11th most attractive location in Asia for the offshore service, and its placement is at the 30th number in the world’s list.

However, the most encouraging number is the financial attractiveness. Pakistan is 5th largest amongst the 50 country index and 3rd most prominent place in the Asian countries. Despite these encouraging facts, they do not have a trusted, user-friendly, safe, and worldwide accepted electronic payment system.

Resultantly, they end up using risky, informal, and illegal platforms for fund transfer. In this situation, they would prefer and require PayPal, which is safer, trustworthy, and offers quick services for customers.

What are the hurdles in the way of PayPal coming to Pakistan?

Several reasons can explain the hesitation of the payment platform to start operating in the country. They include regulatory restriction, money laundering, fraudulent activities, and capital flight, added the report.

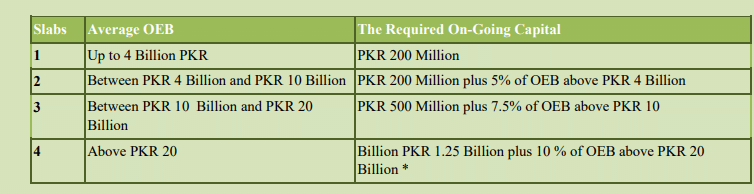

The most likely key concern for PayPal for entering the Pakistani market is the long list of regulatory restrictions. According to the State Bank of Pakistan (SBP) regulations for Electronic Money Institution (EMI), the EMI has to maintain the initial/startup capital requirement of Rs. 200 million for operating in Pakistan.

Furthermore, the EMIs are also required to maintain the minimum ongoing capital at all times. There are different slabs of ongoing capital according to the Outstanding E-money Balance (OEB).

The second important issue in the regulatory restriction is that the payment service providers (aka EMI) would have to undergo a three-stage approvals process for a license: in-principle approval, pilot operations, and complete operations.

Thus they have to give a lot of time and money to be a payment service provider in Pakistan.

In addition to this, multiple regulations regarding customer due diligence would also be needed to be followed. After reviewing the regulations for EMI, one can easily deduct that the whole responsibility will be transferred to EMI in case of any illegal or suspected transfers of money.

So, if such strict regulations existed in the US, perhaps such firms could not start a business. It may also be noted that PayPal is said to operate with minimum profit margins as compared to other online fund transfer systems like Payoneer, and such high costs for regulatory purposes would not fit in their business model.

Sadly, the regulatory quality of Pakistan is almost the lowest, just above Bangladesh, amongst the Asian countries. In addition to this, the ‘Economic Freedom Index (EFI) ranks Pakistan 135th out of 180 countries (2020).

Therefore, unnecessary regulations are one of the key hurdles to invite PayPal into our market. PayPal is a business entity. Therefore, they will not come in the presence of strict regulations and low profit. The Pakistani market is not a low-hanging fruit for them. Businesses always flourish with incentives instead of restrictions.

Argument about Money Laundering and FATF

The other vital concern of PayPal for not entering into the Pakistani market is money laundering. There is a concern that money laundering activities have been increased in Pakistan over the past few years.

Therefore, the Financial Action Task Force (FATF) has placed Pakistan on the grey list. Therefore, due to FATF, the international electronic payment service providers or EMIs have to comply with strict regulations for customers and avoid money laundering. Otherwise, the SBP has the power to cancel their licenses.

We argue that money laundering is not a big issue for the PayPal company. The company is working in several countries with a higher risk of money laundering than Pakistan.

The figure shows the countries where PayPal is working or providing full or partial services have a much higher risk of money laundering than Pakistan.

Interestingly, several countries are placed on the grey list of FATF, but PayPal is working in those countries fully or partially. So, the AML and the FATF are less concerned from the PayPal point of view.

The Willingness of the Government and SBP

The report said that “Overall government attitude in Pakistan is not supportive of digital currency and digital payments. For example, a digital currency like Bitcoin is not allowed in Pakistan. The ratio of regular users of alternate delivery channels (ATM, electronic transfers, e-wallets) is still very low in Pakistan.”

There may also have been the issue of a central payment gateway. Although PayPal acts as a digital wallet in the USA market, however, for some countries, it only acts as an institution for money transfer.

However, for this, there must be a central platform from where they can transfer to any bank. Such a central platform does not exist in Pakistan.

The Capital Controls

From the SBP point of view, the exchange control regime and data privacy are the major obstacles in the way of PayPal entering the Pakistani market.

According to the SBP, the PayPal funds transfer mechanism is based on the bidirectional way. Therefore, the outflow of foreign exchange may create extra pressure on the external sector of Pakistan.

“This may be true for the other countries which have weak foreign exchange buffers. It is also interesting to note that Pakistan is not the only country that has strict capital control. In almost all countries, except Singapore and UAE, the capital control regimes of the countries are at par or stringent than Pakistan. Interestingly, PayPal is working in almost all countries. So, capital control is not the biggest concern of PayPal,” the report added.

What Would PayPal need from Pakistan?

PIDE in its report further stated that” We have established an argument that the FATF, money laundering, exchange control restrictions, etc., are not the main concerns of PayPal for entering any market. PayPal is a business company, a business with a good profit margin with a lot of ease of doing business.”

“There are a lot of things that PayPal analyses before entering a market, but here we mention a few which are based on anecdotal shreds of evidence. These are related to E-commerce, payment methods, online merchants, and risk management,” said the report.

E-Commerce

The e-commerce business is the pivotal detriment to the existence of PayPal in any market. They are interested to look into:

- The total volume and value of online purchases by Pakistani consumers.

- Similarly, the total volume and value of online selling by the Pakistani merchants.

- The PayPal company is also interested to look into the growth rates of sale and purchase for a longer period.

- The percentage of the total online intra-border transferred money, that is, the transfer between local consumers and merchants.

- Similarly, the percentage of the online international transferred money, that is, the transfer between Pakistani and non-Pakistani consumers and merchants.

Payment Methods and Penetration Rate

- What are and how many electronic/online payment methods, payment systems, and platforms are available for online transactions.

- What is the penetration rate of each payment system or payment method? That is, what percentage of the population owns the online payment, that is credit/debit cards. How actively they are using it.

- What is the percentage of total e-commerce activities are used by each electronic payment system?

- Importantly, they also analyze the risk profiles of these payment methods.

Online Merchants

- They also closely look at a list of some main merchants that may use the services of PayPal for their incoming or outgoing payments.

- The total online transaction volume of the major merchants is also monitored.

- The concentration of e-commerce is also important in this regard. That is, what percentage of total e-commerce/online transactions are related to top merchants.

Risk Management

The company also analyses the list of data privacy, compliance of due diligence, and regulations that are relevant to PayPal or payment service providers. If there are easy ways to adopt these rules and regulations by PayPal without making major product changes then it will be a healthy sign for the starting of the business in any market.

So What to Do Next?

This note concludes that the regulatory framework for EMIs in Pakistan, the e-knowledgebase of the government, and the market, especially, friendly market environment are the bigger concerns for PayPal.

On the other hand, PayPal does not have a big issue with money laundering, FATF, and exchange control regimes. If the government of Pakistan and the SBP is really serious to invite PayPal, then they have to take serious actions in this regard. The recently launched reform agenda of PIDE (2021) also argue that e-governance, optimal regulations, internet access, and a friendly market environment are the key drivers for future economic activities.

Therefore, this note suggests to the policymakers that this is a very critical time to think in this way. Otherwise, Pakistan will be far behind the competitors in the field of the electronic payment system, which is a key component of future transactions.

Courtesy: Pro Pakistani